April 2022

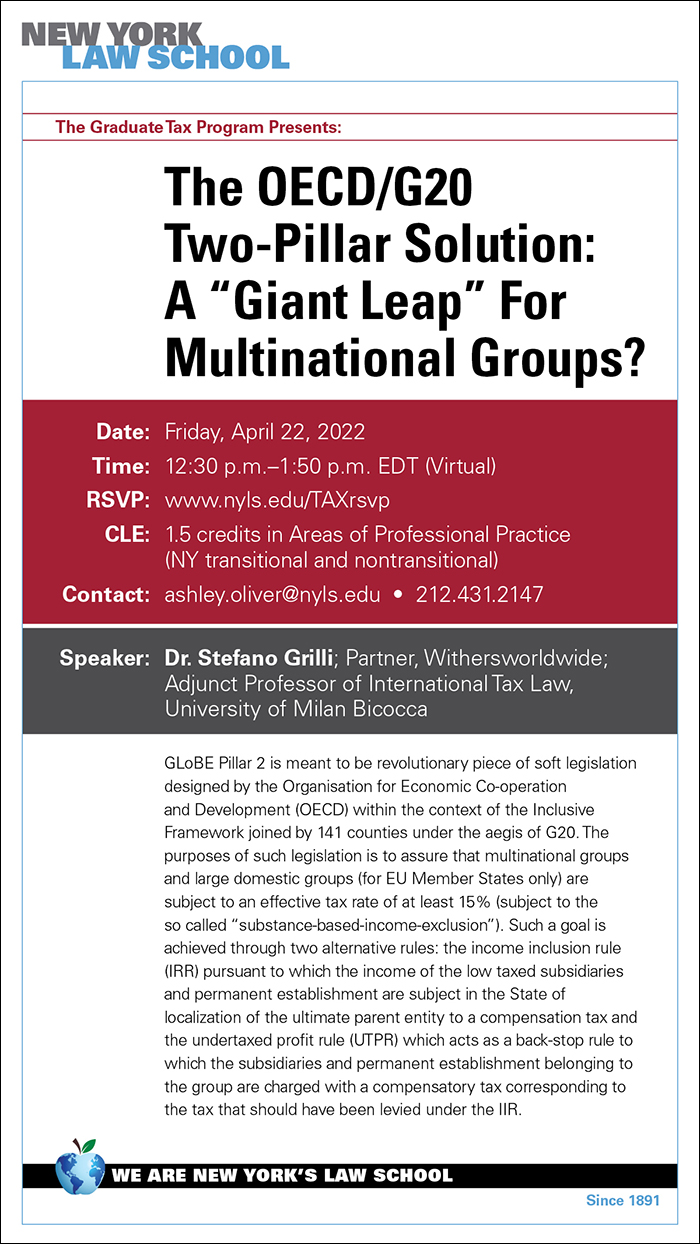

fri22apr12:30 pmfri1:50 pmThe Oecd/G20 Two-Pillar Solution: A “Giant Leap” For Multinational Groups?

Event Details

Download PDF Invite.

Event Details

GLoBE Pillar 2 is meant to be a revolutionary piece of soft legislation designed by the Organisation for Economic Co-operation and Development (OECD) within the context of the Inclusive Framework joined by 141 counties under the aegis of G20. The purposes of such legislation is to assure that multinational groups and large domestic groups (for EU Member States only) are subject to an effective tax rate of at least 15% (subject to the so called “substance-based-income-exclusion”). Such a goal is achieved through two alternative rules: the income inclusion rule (IRR) pursuant to which the income of the low taxed subsidiaries and permanent establishment are subject in the State of localization of the ultimate parent entity to a compensation tax and the undertaxed profit rule (UTPR) which acts as a back-stop rule to which the subsidiaries and permanent establishment belonging to the group are charged with a compensatory tax corresponding to the tax that should have been levied under the IIR.

DATE

Friday, April 22, 2022

TIME

12:30 p.m.–1:50 p.m. EDT (Virtual)

CONTACT

ashley.oliver@nyls.edu • 212.431.2147

CLE

1.5 credits in Areas of Professional Practice

(NY transitional and nontransitional)

SPEAKERS

Dr. Stefano Grilli; Partner, Withersworldwide; Adjunct Professor of International Tax Law, University of Milan Bicocca